Protect yourself

UK consumers lost over £1bn to fraudsters in 2023 and more than £570 million in the first half of 2024 (UK Finance Fraud Reports).

We’ve created a helpful checklist of actions you can take to stop fraud.

Together, we won’t let the fraudsters win.

Types of fraud targeting consumers

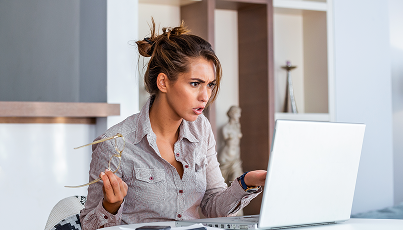

Shopping Online

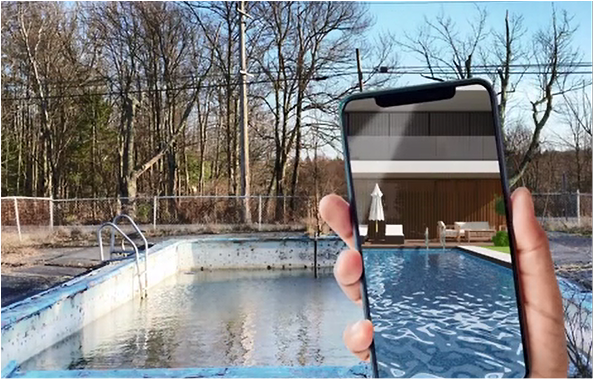

Today’s cybercriminals are highly skilled at creating fake websites, and persuading consumers to divulge sensitive information and make payments.

Investment and Recovery Agent Fraud

An investment scam is when a criminal convinces a victim to move their money to an account.

Suspicious Texts (Smishing)

Smishing is when a criminal tries to trick you into divulging personal and financial details through text messages.

Suspicious Emails (Phishing)

Email is sometimes used to deliver unwanted material. Always be cautious when sending or receiving emails, particularly if you are sending any personal details or arranging financial transactions.

Suspicious Calls (Vishing)

Telephone fraud is becoming increasingly common. Sometimes criminals try to trick you into divulging personal and confidential information. This is known as ‘Vishing’’.

Scam QR Codes (Quishing)

Fraudsters create fake QR codes that take you to a website that looks real. This fake site is made to steal your money or identity by getting your information or infecting your device with malware.

Passwords

The best security in the world is useless if a fraudster has access to a legitimate username and password. Strong passwords can take years to crack; weak passwords can be cracked in less than 5 minutes.

Online and mobile banking

With online or mobile banking being used every day, there are precautions you need to take to ensure that you enjoy the safest banking experience possible.

Public Wi-Fi

When you access public Wi-Fi, you can never be sure who has set up the network and, more importantly, you don’t know who is connected to it.

Social Media

Social media has changed the way we communicate. However, the more information you post online, the more you put yourself at risk of becoming a potential target for fraudsters.

Card and ATM safety

As with all financial transactions, please use discretion when using your card or an automated teller machine (ATM).

Letters

Fraudsters are sending letters to grieving family members as they tie up loose ends such as paying outstanding bills, dividing up possessions and signing official paperwork, lawyers have warned.

Remote Access Fraud

Fraudsters convince people into downloading legitimate screen sharing software to give them access and control of your device.

Protecting your device

There are a number of potential threats online and you need to ensure that you properly protect your devices- mobiles, tablets, laptops or PCs.

Identity Theft (Impersonation)

Identity theft happens when a fraudster steals your personal & financial information and uses it to impersonate you.