Confirmation of Payee

What is confirmation of payee?

Confirmation of payee is a way of helping you make sure that you send money to the right account. It does this by checking the details of the account you want to send money to before you send it. This helps you to avoid paying the wrong person or business. It also helps prevent scams. It works for accounts at UK banks who have signed up to the confirmation of payee service.

What is a payee?

A payee is a person or business you want to pay money to.

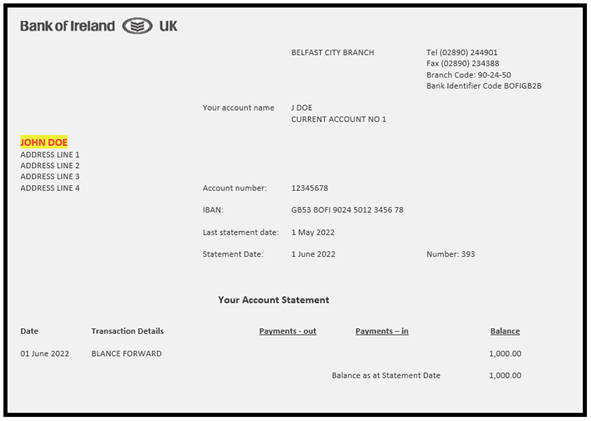

What details does confirmation of payee help to check?

It does this when you set up a new payee or a standing order on 365 online or Business On Line.

Can someone check my payment details if they want to pay me?

Yes. When someone wants to pay you, they can check your details too. This only works if their bank uses confirmation of payee.

Make sure you continue to get paid

Please make sure that people have your correct account details. This means the right sort code, account number, and name. It also means letting people know if your account is a personal or business account. This will help keep your money safe and you will keep getting paid. Remember to let people know if your details change.

Take care when paying anyone new

When you set up a new payee or standing order, make sure you have the correct account details. The right sort code, account number, name and if the account type is personal or business for the person or business you are trying to pay. Check that the request for payment is genuine. Confirm the details directly with someone you know and trust.

Watch out for fraud

Some tell-tale signs of fraud are:

- Someone puts you under pressure to make a payment

- Changes to account details

- People you don’t know asking you to pay them.

How does confirmation of payee work and what does it mean for you?

It checks the account name, sort code and account number matches the one on the payee’s account. Most of the time you will get a match, no match, or a close match. The results you can get are shown below.

For more information see our FAQ How does confirmation of payee work and what does it mean for you?.

| Response | What this means | What you can do | Fraud advice |

|---|---|---|---|

| Yes, it’s a match

| You’ve got the payee’s account details exactly right. | Go ahead and set up the payee or standing order. | Before continuing we recommend checking with the payee that the request for payment is genuine. |

| Close match

| The payee name you entered is very similar to the one on the account of the person or organisation you want to pay. The type of account you entered is different to the type held by the person or organisation you want to pay. | Double check the name and account details you entered. Go back and edit the details or go ahead and set up the payee or standing order. | Confirm the correct name and/or account type directly with the payee. |

| No match

| The payee name you entered is not the same as the one on the account of the person or organisation you want to pay. | Confirm the correct name directly with the payee before continuing. Contact the payee using a phone number you know is genuine. | Think about how you got these account details and why you’re sending this money. If you are in any doubt do not go ahead. If you send funds to the wrong account, you may not get the money back. We strongly recommend that you confirm the correct name directly with the payee before continuing. |

| Account number not found

| The bank is telling us they cannot find that account on their system. | Double check that what you entered is correct and update the details if not. If the details are correct, tell the payee that you are unable to continue. | You will be unable to continue with setting up this payee or standing order. In this instance, you will need to contact the payee to get alternative payment details. |

| Account has been switched

| Unable to check those account details as the account has been switched. | Check the new account details with the payee before continuing. | Check the new account details with the payee before continuing. |

| Reference details not found

| The reference you entered cannot be found. | Check the new reference details with the payee before continuing. | The reference is important as it helps your money reach the intended account. Make sure you complete the reference details before continuing. |

| Unable to check the name / account details

| Unable to check the name or account details on that account. This could happen for a number of reasons:

| We strongly recommend you confirm the name and account details with the payee before continuing. Contact the payee using a phone number you know is genuine. | Please be careful when setting up to transfer money. Only send funds to someone you know and have been able to confirm account details with by phone or face-to-face. |