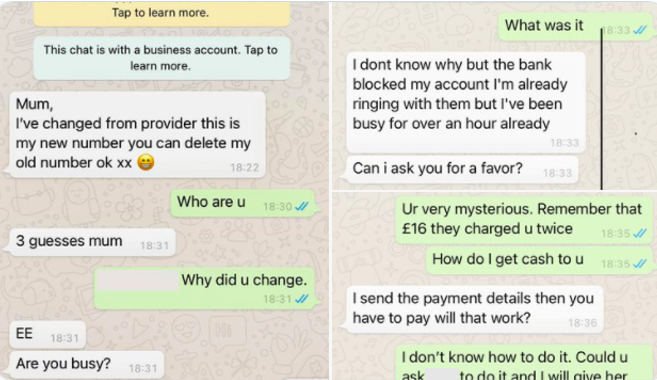

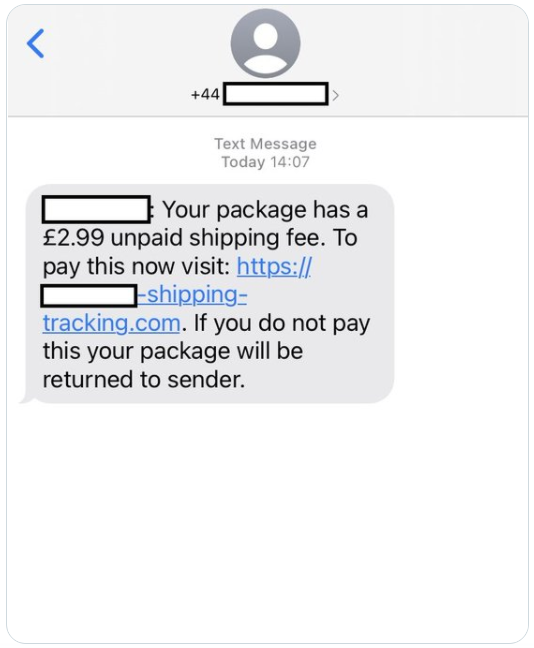

Fraud Awareness Events

Bank of Ireland UK cares about keeping your money safe. To help protect you, we’re offering free fraud awareness events.

These events will take place across Northern Ireland. The locations and dates are listed below. We will announce more events soon.

| Area | Location | Date | Time |

|---|---|---|---|

| More details soon |

Subject to change

Remember to Stop, Think, Check… and together we won’t let the fraudsters win.

Events are also taking place in the Republic of Ireland; dates and locations of these events can be found here: Security Zone – Bank of Ireland Group Website.