-

What is Strong Customer Authentication (SCA)?Strong Customer Authentication (SCA) works to ensure that it is genuinely you making online purchases or banking online. It is designed to help keep your financial information safe and make online purchases and banking even more secure.

-

Does SCA affect me?Yes, if you make online payments using your credit or debit card, SCA will affect you. We are introducing this change to make banking safer for you.

-

How will this work for me?From July this year you will need to use the Bank of Ireland banking app to confirm it is really you who is making the payment. If you don’t have a smart device or are unable to use our Bank of Ireland banking app we can then provide you with a Physical Security Key (PSK).

-

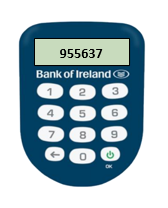

What is a PSK?This is a small, handheld device that generates a new passcode each time to confirm that it is really you who is making the payment when you use your card for some online purchases. If you don’t have a smart device or are unable to use our Bank of Ireland banking app, you will need to order a PSK. For further information on PSKs, click here.

-

Can I opt out of this service?If you want to use your card to shop online, you cannot opt out of this service. You will need to use the Bank of Ireland banking app or, if unable to do so, a Physical Security Key (PSK) to authorise transactions. Under Payment Services Regulations we have to ensure SCA is performed for certain online transactions.

-

I live abroad, do I still have to do this?Yes, to ensure you can continue to use your cards for transactions in the UK & EU or access your accounts online, you will need to be set up for SCA.

-

How will SCA work once introduced?For full details of what the approval steps using the Bank of Ireland banking app will look like, what will happen if you don’t receive the push notification or what to do if using the PSK, please click here to download ‘A Guide to Strong Customer Authentication’ brochure.

Personal Debit Card

-

What do I need to do to get ready for SCA?You will need to be registered for 365 online in order to continue to shop online when SCA is introduced. You will then need to download the Bank of Ireland banking app from the relevant App Store/Play Store for your phone.

If you are not registered for 365 online:

- Please call us on 0345 600 7568 from 9am to 5pm Monday to Friday and we will get you set up.

If you are already registered but have forgotten your 365 online User ID:

- Please text ‘User’ to 50365 and we will reply with your User ID.

If you have forgotten your PIN:

- Please call us on 0345 600 7568 from Monday to Friday 9am to 5pm and Saturday 9am to 2pm, closed Sunday, and we will help you re-set your 365 PIN.

Commercial Debit Card

-

Who is a nominated user for a business current account, and why are they important for business debit cardholders making online payments?

A nominated user is the person who is nominated by the business to use 365 Digital and Phone Banking on behalf of the business. There can only be one nominated user for each business.

Because of the introduction of Strong Customer Authentication, the nominated user will now need to confirm that certain online payments or purchases are genuine. They will need to do this whether it’s them or an additional cardholder making the transaction. The nominated user will have 45 seconds to approve the payment, so is important that they are aware that transactions are being made by additional cardholders in advance.

If you are not registered for 365 Digital and Phone Banking you will need to do so before you can authenticate online payments using a debit card.

-

What if my business current account is not registered for 365 Digital and Phone Banking?

Because of the introduction of Strong Customer Authentication, the nominated user will now need to confirm that certain online payments or purchases are genuine. They will need to do this whether it’s them or an additional cardholder making the transaction. The nominated user will have 45 seconds to approve the payment, so is important that they are aware that transactions are being made by additional cardholders in advance.

If you are not registered for 365 Digital and Phone Banking you will need to do so before you can authenticate online payments using a debit card.

Once registered, you will need to download the Bank of Ireland banking app to confirm it is really you who is making the payment. If you don’t have a smart device or are unable to use our Bank of Ireland banking app we can then provide you with a Physical Security Key (PSK).

-

I am a nominated user with multiple debit cards on my account. What do I need to know?

If you are the person nominated to use 365 Digital and Phone Banking for the business current account, you will now need to confirm that certain online purchases using any of the business debit cards on the account are genuine. This is known as Strong Customer Authentication (SCA).

It does not matter whether it’s you or an additional cardholder making the purchase. If it requires SCA, you, as the nominated user, will need to approve it before the purchase can be completed. This will be the case both for business customers who use the Bank of Ireland app (we recommend this as the easiest way to complete payments using SCA) and for those who use a Physical Security Key. Remember to have your notifications for the Bank of Ireland app switched on.

For more information on how to approve payments using the Bank or Ireland app, see the next FAQ.

If you have additional cardholders on the account, you should advise them of this change. Otherwise, an online transaction that they’re trying to complete may be declined.

-

What the steps for approving a purchase using the Bank of Ireland app will look like:

Before a cardholder can complete certain transactions using one of the company’s business debit cards, a notification requesting your approval will be sent to your primary security device. This is usually your smartphone or tablet. Follow the steps below, using the Bank of Ireland app to approve the transaction.

When the notification has been sent to your device, you will have 45 seconds to approve the payment. Tap on this notification to open the Bank of Ireland app.

Swipe to approve the payment, then on the next screen enter 3 digits of your 6-digit PIN to confirm. You can then exit the app.

Once you have approved, you should let the other cardholder know immediately so that they can complete the payment.

In summary, other cardholders will now not be able to complete any payment that requires SCA without your approval at the time. This is because the notification will only be sent to your primary security device, as you are the only nominated user of 365 Digital and Phone Banking for the business current account. They will need to let you know that they are making a payment, and you will need to approve it when you get the notification as outlined above.

-

What if I do not get a notification asking me to approve a payment?

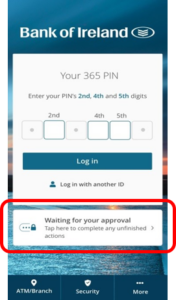

This may happen if you have notifications turned off for your registered primary security device, or you do not have your device to hand when the payment is being made by the main cardholder or an additional cardholder. In this case, you can retrieve the notification yourself following these steps.

Open the Bank of Ireland app on any of the devices that are registered to the 365 online profile for your business current account and tap on Waiting for your approval.

Swipe to approve the payment, and on the next screen enter 3 digits of the 6-digit PIN to confirm.

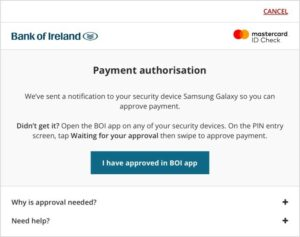

Once you have approved the purchase in the Bank of Ireland app, the person making the purchase can then go back to the seller’s site and complete the transaction there by tapping ‘I have approved in BOI app’.

We recommend that any additional cardholder who is making a payment should let you know in advance, so that you know your approval may be needed. This will save time, especially if you do not get a notification.

-

What if I do not use the Bank of Ireland app but use a Physical Security Key?If you do not use the Bank of Ireland app then you, as nominated user for the business current account, will approve online payments with a Physical Security Key (PSK). You will need to set up your B365 profile and set your B365 PIN before a PSK can be ordered.

-

I am a nominated user with just one card on my account. What do I need to know?

If you are the person nominated to use 365 Digital and Phone Banking for the business current account, you will now need to confirm that certain online purchases using the business debit card are genuine. This is known as Strong Customer Authentication (SCA).

If a transaction requires SCA, you, as the nominated user, will need to approve it before the purchase can be completed. This will be the case both for business customers who use the Bank of Ireland app (we recommend this as the easiest way to complete payments using SCA) and for those who use a Physical Security Key. Remember to have your notifications for the Bank of Ireland app switched on.

-

I am an additional business debit cardholder. What do I need to do differently because of SCA when making online payments?

If you are an additional cardholder but not the nominated user, we recommend that you let the nominated user know about the transaction in advance. That way they will know to expect a notification that their approval is needed when you are making the transaction.

When the SCA notification to approve your payment has been sent to the nominated user’s primary security device, they will have 45 seconds to do so.

If they do not use the Bank of Ireland app (this is the easiest way to complete payments using SCA), they will need to approve your payment using a Physical Security Key instead.

-

How long does the nominated user have to approve the transaction?

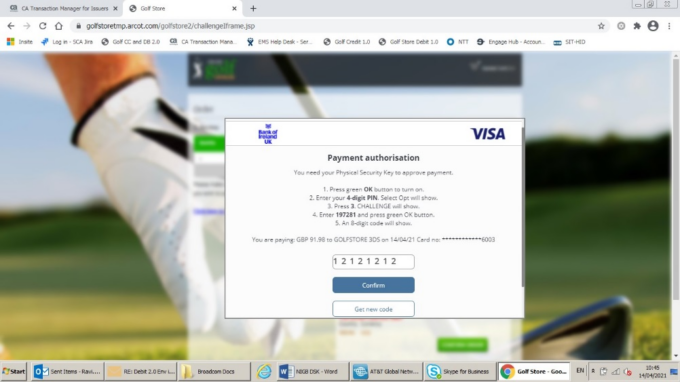

When a cardholder shops online and goes to complete their purchase, they will see a screen on the seller’s site that looks similar to this one. Once it appears, the nominated user has 45 seconds to approve the transaction. If using a PSK, the nominated user has 5 minutes from when the additional cardholder presses pay to approve the transaction.

We appreciate that this is a short time frame. If you are an additional business debit cardholder, we recommend that you let the nominated user know about the transaction in advance. That way they will know to expect a notification that their approval is needed when you are making the transaction. If the nominated user uses a Physical Security Key rather than the Bank of Ireland app to approve payments, you will need to be with them or in contact with them while you are making the payment, so that you can complete the steps to approve it together.

-

What if the nominated user doesn't get a notification when I'm making a purchase?If SCA is required, but the nominated user doesn’t get a notification, it may mean they have notifications turned off for their device, or they do not have the registered primary security device to hand when the payment is being made by an additional cardholder.

-

What if I am the sole cardholder but I am not the nominated user?When you’re making an online transaction and Strong Customer Authentication is required, you will need to contact the nominated user before you can complete the transaction. Only they can approve it and allow payment to happen.

-

What if I am the nominated user but I do not have the Bank of Ireland app?We recommend that you download the Bank of Ireland app from the App Store or Google Play. Once SCA is introduced, the easiest way to approve a transaction will be through the app, regardless whether it’s you or another cardholder using your business debit card online. If you cannot use the app then you will need to use a Physical Security Key (PSK). You will need to set up your 365 Digital and Phone Banking profile (by appointing a nominated user) and set your 365 PIN before a PSK can be ordered.

-

I am an additional cardholder, can I still make online payments?

Short answer: Yes, but with the approval of the nominated user. This is the person who is nominated to use 365 Digital and Phone Banking for the business current account. The difference that SCA makes is that additional cardholders may now need the nominated user to authenticate the transaction before they can be completed using the business debit card.

You will not always be asked for this, but when it is needed, the nominated user is the only one who can approve the transaction you are making.

-

Why can't other cardholders approve certain online transactions?For any business current account, only one person is nominated to use 365 Digital and Phone Banking. This nominated user is the only one who can approve transactions other cardholders may wish to make. Any additional debit cardholder will now need the nominated user to confirm certain online payments or purchases as they are being made.

-

I am a BOL user, what does this mean for me?

Business on Line users can continue to use BOL for day-to-day banking. However, to authenticate online payments using a business debit card, one person from your business must be nominated as the nominated user. They will need to register for 365 Digital and Phone Banking and download the Bank of Ireland app, and get set up to make online card payments. We will need to set you up for 365 Digital and Phone Banking.

To appoint a nominated user for your business you will need to have each signatory sign a 365 Digital and Phone Banking Nominated User form for Business Customers. You can complete it at here. Once we receive it we will be in touch so you can receive your security credentials.

-

What will the nominated user have access to?The nominated user will have access to the business’s bank accounts and will have the ability to view account balances, make payments, create/delete payees, and create/delete standing orders.

-

I don’t want to give access to the company’s bank accounts to one person, are there any alternatives available?If you do not want to appoint one nominated user, a business commercial card may be a suitable alternative for additional cardholders. You can find out more by contacting your account manager.

-

What’s the difference between Business Commercial Card and Business Debit Card Holders for SCA?Commercial card holders can authorise their own transactions because business commercial cards are linked to the cardholders own 365 Digital and Phone banking profile. It is not linked to the365 Digital and Phone Banking profile of the business.

-

The authorised signatories on my account have changed. How do I update them before I appoint a nominated user?You will need to complete a new business mandate and appoint new signatories. You can request a form from your account manager.

-

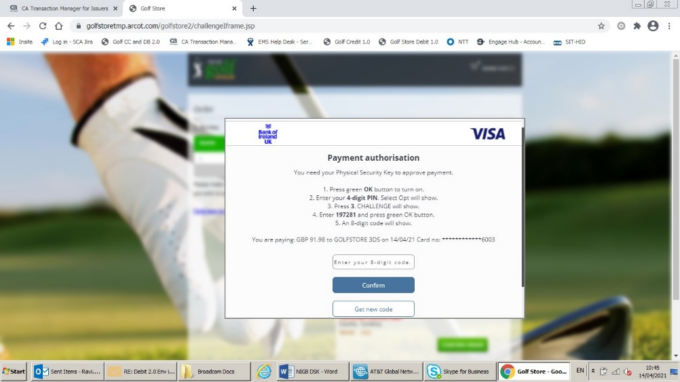

What the steps for approving a purchase using a PSK will look like:

When an additional cardholder is making a payment that requires SCA, they will need to be in contact with you, the nominated user, at the time so that you can follow the steps below, using your PSK to approve the purchase. You will have 5 minutes from when the cardholder presses pay to approve it. Please take the necessary steps to ensure that it is really the additional cardholder for your business you are in contact with before sharing any codes with them. This is the only scenario where we will ask you to share codes with someone else.

When an additional cardholder goes to complete a purchase, they will see a payment authorisation screen similar to the below. This screen will give the additional cardholder a one-time code – 197281 in example below – which they must share with you, the nominated user.

You, the authorised user, must then turn on your PSK by pressing the green OK button. When prompted, enter your 4-digit PSK PIN. The screen will show ‘Select Opt’.

Then press 3. The screen will show the word ‘Challenge’.

Next, enter the one-time code that the additional cardholder has shared with you – 197281 – and press the green ‘OK’ button.

An 8-digit number will now show on the PSK screen. In the example below we have used the number 12121212. Share this with the additional cardholder, so that they can complete the payment.

Once the additional cardholder has this 8-digit code, they can continue with their payment by entering the code into the payment authorisation screen and pressing ‘Continue’ to complete the payment.

The customer will be brought back to the merchant screen which will confirm payment is completed.

Commercial Credit Card

-

What do I need to continue to shop online once SCA is introduced?You will need:

- To be registered for 365 online,

- To download the Bank of Ireland banking app,

- To add your credit card to your profile.

If you have all of the above then, great! You are ready for when our SCA change is introduced to continue to make payments online. If you haven’t got all of the above, please see the next two sections.

-

I am a current account holder and I have a commercial credit card but I am not registered for 365. What do I need to do?In order to continue to use your credit card to shop online you will need a 365 online profile for your credit card. To get set up:

- Please call us on 0345 600 7568 from 9am to 5pm Monday to Friday and we will get you set up.

- You will then need to download the Bank of Ireland banking app from the relevant App Store/Play Store for your phone and log in.

Once you are registered for 365 online, and have downloaded the Bank of Ireland banking app, you can add your credit card.

Here’s how:- Log in to the Bank of Ireland banking app or 365 browser

- Go to ‘Services’

- Scroll down to ‘Manage Accounts’

- Click on ‘Add your Account or Policy’

- Select your account type and then type in the requested details

Please note if your commercial credit card is under a different name to your personal or business current account it cannot be added to your existing 365 profile.

If this is the case, please see the ‘I have a commercial credit card but I do not have a current account’ section below for more information.

-

I have a commercial credit card but I do not have a current account. What do I need to do?If you do not have a current account we will need to get you set up with a 365 profile. You will then be able to download the Bank of Ireland banking app in order to continue using your credit card online.

If you are yet to register your 365 profile, please call us on 0345 604 1070 to complete your set up.

How do I appoint a nominated user for my business?

To appoint a nominated user for your business you will need to have each signatory sign a 365 Digital and Phone Banking Nominated User form for business customers. This form also requires a customer resolution signed by two of the following (depending on entity type) director / secretary / partner / management committee member or elected official of the customer.

To obtain the form please contact your relationship manager or branch.