Please see below for details on recent fraud alerts.

- Fraudsters using spoof bank texts in a new scam

- Malicious Software

- Pension Liberation

- Scam Calls

- Fraud against the elderly

- Money mules (job vacancies)

- Lottery fraud

-

Coronavirus related scams

Fraudsters are exploiting the spread of COVID-19 coronavirus to facilitate various types of fraud and cyber crime.

Reports were made by victims that attempted to purchase protective face masks from fraudulent sellers and also coronavirus-themed phishing emails in an attempt to trick people into opening malicious attachments or revealing personal and financial details.

Watch out for scam messages:

Don’t click on the links or attachments in suspicious emails, and never respond to unsolicited messages and calls that ask for your personal or financial details.Shopping online:

If you’re making a purchase from a company or person you don’t know and trust, carry out some research first, and ask a friend or family member for advice before completing the purchase. If you decide to go ahead with the purchase, use a credit card if you have one, as most major credit card providers insure online purchases.For more information on how to shop online safely, please visit: https://www.actionfraud.police.uk/shoponlinesafely

Protect your devices from the latest threats:

Always install the latest software and app updates to protect your devices from the latest threats.For information on how to update your devices, please visit:

https://www.ncsc.gov.uk/guidance/securing-your-devices

For information about Coronavirus please visit:

https://www.nhs.uk/conditions/coronavirus-covid-19/

-

Invoice Redirection Fraud (Business banking)

We have seen an increase in Invoice Redirection fraud in 2020.

Invoice Redirection fraud is where fraudsters pretend to be a supplier or service provider for your business in order to trick you into changing bank account payee details. They contact you to tell you that their bank account details have changed and to ask you to send all payments to a new account. This is an account controlled by the fraudster.

What to look out for

- The fraudsters may write to your company’s finance or payments department either on forged headed paper or by email, pretending to be one of your suppliers.

- Typically, they tell you that their account details have changed.

- The payee account may be located either in the UK or overseas.

- The fraudster may ask an employee in your company to either send a pending payment to the new account or, alternatively, to ensure that all future payments are sent to the new account.

What you can do

If a company requests a change of payment details, always follow these simple verification steps before making payments:

- Verify the change by contacting a known contact in the company directly, using contact details held on record, or by using a phone number displayed on the company’s website. Links or contact details contained in the email or letter requesting the change could be fraudulent. Don’t use them.

- Fraudsters may change an email address to make it look as though it has come from someone you are used to dealing with. Always check email addresses carefully.

- Regularly review supplier records to ensure they are up to date.

- Ensure that your employees are aware of this type of threat and how to avoid it.

- Contact us immediately if you receive a suspicious email or letter relating to payments or the Police if you think you have been the victim of fraud.

We encourage you to Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

To report online fraud, suspicious activity on your account, or if you have provided personal information in response to a suspicious email, text or phone call.

Call us on:

Northern Ireland

Freephone (Business accounts): 0800 032 1288 (24 hours, 7 days a week).

Business online: 0345 309 8123

Great Britain

Business Online: 0345 309 8124

Republic of Ireland

Business Online: 1890 818 265Abroad

Business Online: +353 1 440 6445

Business Online Opening hours: Monday-Friday 8am-6pm. Closed Saturday, Sunday, Bank and Public holidays.To report suspicious Bank of Ireland related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.

If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

-

Scam phone calls and fake text messages from fraudsters pretending to be from Bank of Ireland UK (BOIUK)Fraudsters are contacting BOIUK customers either by phone (vishing) or by text (smishing) and gaining enough personal and bank information to make fraudulent payments from customer’s accounts.

Scam Phone calls (Vishing)

Fraudsters are calling BOIUK customers pretending to be from a BOIUK fraud department. They claim that your account has been compromised and ask for your personal data, bank card or bank account details.What you can do

- Don’t give away personal or banking information. No matter what story you are told, if it seems a bit odd or out of the blue, don’t give away your passwords, personal details or banking details.

- If you receive a suspicious call, hang up and don’t call back any number the caller may have given you. Remember: Bank of Ireland will never ask for your full login PIN or full banking details over the phone.

- If you have accidentally shared your banking information over the phone and you are worried, call us immediately on one of our numbers listed below. Fraudsters can stay on the line after you have finished the call, so either use a different phone to report the incident or wait a few minutes and then call someone you know first, so that you can be sure the fraudster has disconnected completely.

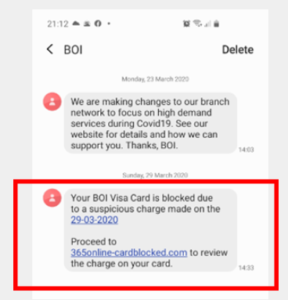

Fake Text messages (Smishing)

Fraudsters are sending fake text messages to BOIUK customers pretending to be from us, the text messages can appear in your existing message feed with BOIUK, so they can be hard to identify. The text messages could have a link to a fake BOIUK website, or it could provide you with a fake telephone number to call. Customers are being asked to remain vigilant against fraud.Remember, Bank of Ireland UK will never:

- Send you a text or email with a link directly to the login page of our online banking channels to confirm banking details or ask you to update their banking details

- Ask you to click a link in an email with an urgent warning about suspicious activity on your account

- Ask you to transfer money out of your account to protect you from fraud

- Ask you to tell us any ‘one-time password’ or code that you have received from us by text

- Ask you to share or send us your full six-digit 365 PIN, four-digit card PIN or Business On Line credentials

- Ask you to send us back your bank card

For more information on how to protect yourself please refer to the Protect yourself link in our website.

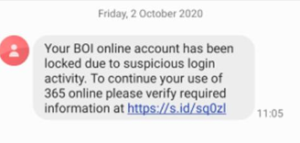

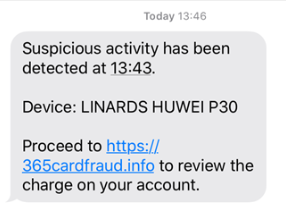

Examples of smishing

Please see below some examples of smishing

For more smishing examples please refer to our gallery of phishing and smishing examples here.

Report Fraud

If you suspect suspicious activity on your account, or if you have provided personal information in response to a suspicious email, text or telephone call, please contact us as soon as possible on the below contact numbers:Northern Ireland

Freephone (Personal accounts): 0800 121 7790 (24 hours, 7 days a week).

Freephone (Business accounts): 0800 032 1288 (24 hours, 7 days a week).

365 Online: 0345 7 365 555

Business Online: 0345 309 8123Great Britain

365 Online: 0345 7 365 333

Business Online: 0345 309 8124Republic of Ireland

365 Online: 1890 365 200/ 0818 365 365

Business Online: 1890 818 265Abroad

365 Online: +44 345 7365 555

Business Online: +353 1 440 6445365 Opening hours: Monday-Friday: 8am-8pm, Saturday: 9am-5pm, Bank and Public holidays: 10am-5pm, Sunday: Closed.

Business Online Opening hours: Monday-Friday 8am-6pm. Closed Saturday, Sunday, Bank and Public holidays.

If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

To report suspicious Bank of Ireland related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com

-

COVID-19 Vaccine Scam Alert

The purpose of this alert is to warn Bank of Ireland UK customers of a new scam circulating where fraudsters are using the COVID-19 vaccine rollout as an opportunity to try to steal your data.

Summary

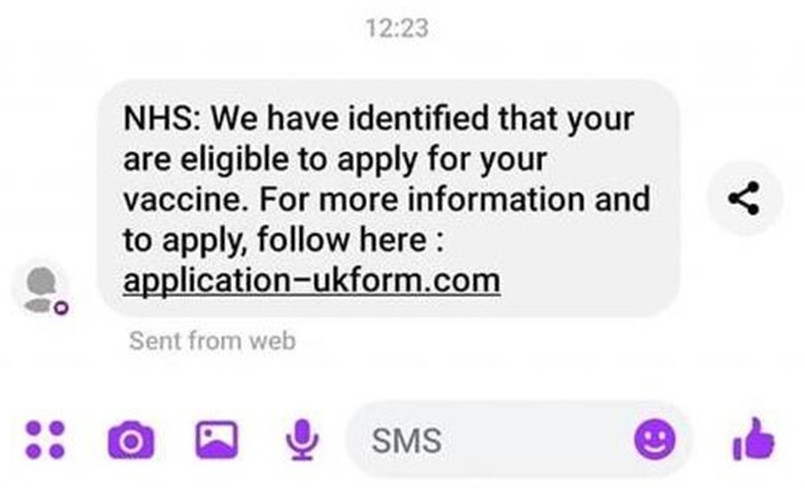

Bank of Ireland UK have been informed that there is a new scam text message circulating in which fraudsters are posing to be from the NHS. The text message informs the recipient that they are eligible to apply for the COVID-19 vaccine and asks them to click on a link. The link takes the recipient to a fake NHS website and prompts them to enter their bank account details (including sort code, account number and card number) to verify their address. Please remember that the NHS, or your doctor would never ask you for this type of data.

An example of the scam text message is shown below.

We would like to remind our customers to remain vigilant against fraud. The above image is an example of a fraudulent text message that has been sent to an individual, however fraudsters will try to trick people by sending different variations of the same scam. Fraudsters also use different means of communication, other ways fraudsters may try to contact you is by email or telephone.

How to protect yourself

Suspicious texts (Smishing)

Fraudsters may send texts pretending to be from a company you trust. They target mobile users by sending texts with links to fraudulent websites to trick you into providing your online banking details or card details.

You should never:

- Click on or open suspicious links and attachments.

- Use a phone number provided in the text which could be fake.

- Respond to unsolicited text messages.

- Share your banking details, including your full online banking PIN, or other personal information if requested via text message.

If you have clicked on a suspicious link, call us as soon as possible on the phone numbers provided below.

Suspicious emails (Phishing)

Fraudsters sometimes send emails pretending to be from a company you trust, usually asking you to click on a link or open an attachment. The emails may seem genuine and convincing but are designed to trick you into sharing your personal information, such as your username, full PIN or credit card number. They will often make urgent threats and try to scare you into providing your details.

You should never:

- Click on or open suspicious links and attachments.

- Respond to unsolicited emails.

- Share your banking details or other personal information if requested via email.

- Use a phone number provided in the email which could be fake.

If you have clicked on a suspicious link, call us as soon as possible on the phone numbers provided below.

Suspicious calls (Vishing)

Fraudsters may contact you be telephone pretending to be calling from a company you trust. Be vigilant if you receive a phone call out of the blue. The fraudsters may claim that your account has been compromised and ask you for your bank card or bank account details.

You should never:

- Give away personal or banking information. No matter what story you are told, if it seems a bit odd or out of the blue, don’t give away your passwords, personal details or banking details.

- Use a phone number the suspicious caller gave you.

If you have accidentally shared your banking information over the phone and you are worried, call us as soon as possible on the phone numbers provided below. Fraudsters can stay on the line after you have finished the call, so either use a different phone to report the incident or wait a few minutes and then call someone you know first, so that you can be sure the fraudster has disconnected completely.

Further information

To find out more about fraudster Tactics, and what you can do to protect yourself please refer to the Fraudster tactics section of our website.

Report Fraud

If you suspect suspicious activity on your account, or if you have provided personal information in response to a suspicious email, text or telephone call, please contact us as soon as possible on the below contact numbers:

Northern Ireland

Freephone (Personal accounts): 0800 121 7790 (24 hours, 7 days a week).

365 Online: 0345 7 365 555Great Britain

365 Online: 0345 7 365 333Republic of Ireland

365 Online: 1890 365 200/ 0818 365 365Abroad

365 Online: +44 345 7365 555365 Opening hours: Monday-Friday: 8am-8pm, Saturday: 9am-5pm, Bank and Public holidays: 10am-5pm, Sunday: Closed.

To report suspicious Bank of Ireland related emails or texts, send the suspicious email or text to 365security@boi.com

If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

-

Romance scamsThe UK has seen a rise in people falling victim to Romance scams during Lockdown. The rise comes as more people have turned to online dating during 2020 due to social distancing restrictions. The purpose of this Fraud Alert is to inform Bank of Ireland UK customers about Romance scams and how to protect yourself, your friends and family from Romance scams this Valentine’s Day.

New data from UK Finance reveals a 20 per cent increase in bank transfer romance fraud between January and November 2020 compared to the previous year, with the total value of these scams rising by 12 per cent to £18.5 million. The average loss per victim reported to UK Finance members was £7,850, highlighting the significant impact this type of fraud can have on victims’ finances.

What is a Romance scam?

A Romance scam is when a person is duped into sending money or gifts to a fraudster because they believe they are in a genuine relationship and are sending them to their ‘partner’.

Romance scams usually start with people meeting online; through dating websites or social media. Fraudsters often use fake profiles and spend a lot of time getting to know the victim to convince them that they are in a genuine relationship. Once the fraudster believes they have gained the victim’s trust they will ask for money or gifts that seem genuine; the fraudster could say they need money for emergency medical care, or to pay for travel costs if the victim lives overseas. There are numerous reasons, but the key is that money is requested, yet neither party have ever met.

What to look out for

When you are dating someone online, look out for the below alarm bells:- Requests for money or gifts from someone you have never met in person.

- Requests for your personal data (e.g. a copy of your passport to arrange travel).

- Does the person’s profile look genuine? You can complete a reverse image search to find if their profile picture has been taken from somewhere else.

When your friends or family are dating someone online, look out for the below warning signs:

- Being secretive about their relationship.

- Sending money or gifts to someone they have never met in person.

- Committing to someone very quickly, when they have not met in person.

Protect yourself

- Be cautious when providing your personal information. The more information you provide about yourself the easier it is for a fraudster to steal your identity.

- If you notice any of the above alarm bells don’t be pressured into transferring your money, or spending your money to buy gifts.

- Never reveal your banking information to anyone, including your account details, online banking information, card number & pin.

No matter how long you’ve been speaking to someone online and how much you think you trust them, if you have not met them in person it’s important that you do not:

- Send them any money

- Allow them access to your bank account

- Transfer money on their behalf

- Take a loan out for them

- Provide copies of your personal documents such as passports or driving licenses

- Invest your own money on their behalf or on their advice

- Purchase and send the codes on gift cards from Amazon or iTunes

- Agree to receive and/or send parcels on their behalf (laptops, mobile phones etc.)

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

If you think you have been a victim of a Romance scam, do not feel ashamed or embarrassed – you are not alone. Contact us immediately on:- Northern Ireland

Freephone (Personal accounts): 0800 121 7790 (24 hours, 7 days a week).

365 Online: 0345 7 365 555 - Great Britain

365 Online: 0345 7 365 333 - Republic of Ireland

365 Online: 1890 365 200/ 0818 365 365 - Abroad

365 Online: +44 345 7365 555

365 Opening hours: Monday-Friday: 8am-8pm, Saturday: 9am-5pm, Bank and Public holidays: 10am-5pm, Sunday: Closed.

To report suspicious Bank of Ireland related emails or texts, send the suspicious email or text to 365security@boi.com

If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

-

2022 Holiday ScamsBank of Ireland UK would like to remind our customers to remain vigilant against holiday scams this summer as restrictions continue to ease.

Holiday scams

Fraudsters set up fake websites and social media profiles where they offer travel deals, concert and festival tickets that are either fake or do not exist. These websites are used to obtain your money and information. The websites usually look genuine so can be hard to spot but if you follow the below steps you can help protect yourself from falling victim to these scams:

- Don’t click on links sent to you by email, text message or social media.

- Search for the website by typing it into the web browser. When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- That a closed padlock icon is present.

- Your browser address window may be green.

- If it’s too good to be true it probably is – do some research on the company/ website.

- When booking holidays consider booking directly with an established hotel or through a reputable travel company that is a member of a trade body such as ATOL.

- Always use secure payment options and don’t make payment by funds transfer.

- Where possible, use a credit card when making payments over £100 and up to £30,000 as you receive protection under Section 75 of the Credit Consumer Act.

- Follow us on Twitter @BankofIrelandUK to be informed of trending scams.

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.

Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:

Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)Calling from ROI

Freephone: 1800 946 764 (personal and business)Calling from Overseas

Not Freephone: 00353 567 757 007Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

-

2021 Summer Scams

Bank of Ireland UK would like to remind our customers to remain vigilant against fraud this summer as restrictions start to ease. Fraudsters are targeting victims with concert/festival ticketing scams, travel scams, and health insurance scams. Please see below for more information about these scams and how you can protect yourself.

Holiday & ticketing scams

Fraudsters set up fake websites and social media profiles where they offer travel deals or event, concert, and festival tickets that are either fake or do not exist. These websites are used to obtain your money and information. The websites usually look genuine so can be hard to spot but if you follow the below steps you can help protect yourself from falling victim to these scams:

- Don’t click on links sent to you by email, text message or social media. Search for the website by typing it into the web browser. When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- That a closed padlock icon is present.

- Your browser address window may be green.

- If it’s too good to be true it probably is – do some research on the company/ website.

- When booking holidays consider booking directly with an established hotel or through a reputable travel company that is a member of a trade body such as ATOL.

- Always use secure payment options and don’t make payment by funds transfer.

- Where possible, use a credit card when making payments over £100 and up to £30,000 as you receive protection under Section 75 of the Credit Consumer Act.

Global Health Insurance Card (GHIC) scams

When travelling in the EU people can access emergency and medical care with a Global Health Insurance Card (GHIC). This card has replaced the European Health Insurance Card (EHIC) however fraudsters are capitalising on this new card to commit fraud, asking victims for payment details when the GHIC is free. Fraudsters are advertising these cards on fake websites that look like that of the NHS. The sites claim to either fast-track or manage your application process before charging you an up-front fee. You can help protect yourself from falling victim to these scams by following the below steps:

- Don’t click on links sent to you by email, text message or social media. When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- That a closed padlock icon is present.

- Your browser address window may be green.

- Be suspicious of unsolicited emails, texts, phone calls and social media messages. Listen to your instincts. If something doesn’t feel right then stop and question it.

- Never reveal your personal information if requested via email, text, phone call and social media message.

Vaccine certificate scams

The UK government is currently looking into the use of vaccine certificates or a passport for people to use once restrictions lift. These will show whether people have been vaccinated, have recently tested negative or have natural immunity after being ill with Covid. As we wait for further information on this from the UK Government, fraudsters will be using the opportunity to target people with fake Covid certificates and passports. Fraudsters may contact people by email, phone call, text message, through social media, fake apps or adverts. Often posts include a link leading to a fraudulent website used to steal your money or personal and financial information. You can help protect yourself from falling victim to these scams by following the below steps:

- Don’t click on links sent to you through email, text message or social media. When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- That a closed padlock icon is present.

- Your browser address window may be green.

- Be suspicious of unsolicited emails, texts, phone calls and social media messages. Listen to your instincts. If something doesn’t feel right then stop and question it.

- Never reveal your personal information if requested via email, text, phone call and social media message.

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

If you suspect suspicious activity on your account, or if you have provided personal information in response to a suspicious email, text or telephone call, please contact us as soon as possible on the below contact numbers:

Northern Ireland

Freephone (Personal accounts): 0800 121 7790 (24 hours, 7 days a week).

365 Online: 0345 7 365 555Great Britain

365 Online: 0345 7 365 333Republic of Ireland

365 Online: 1890 365 200/ 0818 365 365Abroad

365 Online: +44 345 7365 555365 Opening hours: Monday-Friday: 8am-8pm, Saturday: 9am-5pm, Bank and Public holidays: 10am-5pm, Sunday: Closed.

To report suspicious Bank of Ireland related emails or texts, send the suspicious email or text to 365security@boi.com

If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

- Don’t click on links sent to you by email, text message or social media. Search for the website by typing it into the web browser. When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

-

FCA issues a consumer warning on Binance Group

On 26 June 2021, the Financial Conduct Authority (FCA) issued a consumer warning on Binance Markets Limited and the Binance Group. Binance Markets Limited are no longer permitted to undertake regulated activity in the UK.

If you are a Binance Markets/Binance Group customer and want to find out if/how this affects you, please contact the FCA, or Binance Group/Binance Markets directly.

For more information on the FCA consumer warning, please refer to the FCA website.

-

Bank of Ireland UK (BOIUK) Investment Scam

Fraudsters are contacting members of the public, claiming to be from BOIUK offering information on investments/ investment bonds. BOIUK do not offer investment services. If you receive any correspondence claiming to be from BOIUK, offering investment services this is a scam. You may receive this correspondence by phone call, email, text, post, or through social media messages.

Examples of the BOIUK Investments scam emails

Please click on the below links to see examples of the BOIUK Investment Scam emails.How to keep safe

BOIUK do not offer investment services, if you receive any correspondence claiming to be from BOIUK & offering investment services, do not respond and do not provide your personal details or financial information.

If you are considering an investment, before you make any decisions, please remain vigilant against scams. You can do this by independently checking the authenticity of the company you are dealing with. You can check the FCA Warning List of firms to avoid. Learn more by visiting the FCA website for guidance on how to avoid investment scams.

We encourage you to Take Five by following the below steps:

-

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

Lost or stolen card?

As soon as you believe your card has been lost or stolen, please contact us as soon as possible via our Freephone numbers listed below. We’ll cancel your card as soon as you tell us it’s missing and get a new card issued to your address (the one we have on file for you) in 5 to 7 working days.

Fraud, suspicious activity or unauthorised transactions?

To report online fraud, suspicious activity, unauthorised transactions on your account or ATM fraud, please contact us as soon as possible via our Freephone numbers listed below.

Shared your online login details?

If you have shared your banking details in response to a suspicious email, text or call, please notify us as soon as possible via the Freephone numbers listed below.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com

Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:

Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)

Calling from ROI

Freephone: 1800 946 764 (personal and business)

Calling from Overseas

Not Freephone: 00353 567 757 007Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

-

-

COVID-19 related ScamFraudsters are trying to dupe people into paying for proof of their COVID Vaccination status.

ALL proof of vaccination status passes, certificates & letters are FREE

What is proof of COVID Vaccination status?

This is proof of your COVID vaccination status or test results. You may be required to show these to enter an event or to travel.

Where can I get proof of COVID Vaccination status?

Where you obtain your proof of COVID Vaccination status depends on where you live, however please remember that ALL proof of vaccination status passes, certificates & letters are FREE.

If you live in:

- Northern Ireland you can obtain your COVID Certificate from the NI Direct website, or by downloading the COVIDCert NI app from Health & Social Care Northern Ireland.

- England and Whales you can obtain your NHS COVID pass from the NHS website, app or by giving them a call.

- In Scotland you can obtain your vaccination status letter through the NHS Scotland website.

What to look out for:

Fraudsters will try to contact you by email, phone call, text message, through social media, fake apps & adverts, or home visit.

Often posts include a link leading to a fraudulent website where your personal details and financial information are requested. This information is then used to commit fraud, or sold to other criminals to use.

Remember that all proof of vaccination status passes, certificates & letters are FREE.

If you receive a request for a payment hang up, don’t click on the link & don’t provide your personal and/or financial details. Contact us straight away if you are concerned or suspect fraudulent activity on your account.

Below is an example of a fake NHS email and text message currently circulating:

Example of fake NHS email:

Example of fake NHS text message:

How to protect yourself:

Remember that all proof of vaccination status passes, certificates & letters are FREE.

You can help protect yourself from falling victim to these scams by following the below steps:

- Don’t click on links sent to you through email, text message or social media.

- When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- That a closed padlock icon is present.

- Your browser address window may be green.

- Be suspicious of unsolicited emails, texts, phone calls and social media messages. Listen to your instincts. If something doesn’t feel right then stop and question it.

- Never reveal your personal information if requested via email, text, phone call and social media message.

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting or you calling back

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)Calling from ROI

Freephone: 1800 946 764 (personal and business)Calling from Overseas

Not Freephone: 00353 567 757 007Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

-

Black Friday & Cyber Monday Fraud alertBank of Ireland UK would like to remind our customers to remain vigilant against fraud this Christmas period. With Black Friday and Cyber Monday approaching, criminals are attempting to target new victims. Please see below for information on the common Christmas period scams, and how you can protect yourself.

Purchase Scams

Purchase scams occur when a victim pays in advance for goods or services that they never receive. Criminals often use social media platforms, online market place and auction websites to target victims, the victim may not realise they have been a victim of a scam until they do not receive the goods or services they paid for.

How to protect yourself

Criminals may lead you to believe you are dealing with a genuine seller by using fraud tactics. Follow the below steps to help protect yourself from purchase scams:

- Remember, if it’s too good to be true it probably is. Do some research on the person /company/ website before making a purchase.

- Don’t click on links sent to you by email, text message or social media. Search for the website by typing it into the web browser. When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- That a closed padlock icon is present.

- Your browser address window may be green.

- Ask to see the product in person with the relevant documentation to prove ownership before making a payment.

- Where possible, use a credit card as you may receive protection under Section 75 of the Credit Consumer Act.

- Use the secure payment method recommended by reputable online retailers and auction sites and be suspicious of any requests to pay by bank transfer.

Parcel Scams

Parcel scams occur when a victim is duped into making a payment, or providing their personal/ financial information to criminals posing as delivery services. The victim may receive correspondence by email, text or post from criminals posing to be a well-known delivery service, the criminals claim that they have been unable to deliver parcels or large letters.

How to protect yourself

Criminals may lead you to believe you are dealing with a genuine delivery service by using fraud tactics. Follow the below steps to help protect yourself from parcel scams:

- Don’t click on links sent to you by email, text message or social media.

- Whether you are expecting an item or not, if you receive correspondence to say that an item could not be delivered – Don’t click on the links; check the advice on the retailers / delivery services’ genuine website. Search for the website by typing it into the web browser. When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- That a closed padlock icon is present.

- Your browser address window may be green.

- Report suspected scam text messages to your mobile network provider by forwarding the text message to 7726 (SPAM).

Take Five to Stop Fraud

We encourage you to #ShopSavvy this Christmas period, and to #Take Five by following the below steps:

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

- If you’re asked to pay by bank transfer not with a secure payment option – that is a red flag

- You should not be asked for security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting or you calling back

- You can always change your mind and not go with an offer if you feel it is dodgy

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.Check if the Bank of Ireland UK text is legitimate

You can check the legitimacy of any Bank of Ireland UK text you receive, using our new ‘TextChecker’ service, simply send the word ‘Check’ followed by the Bank of Ireland UK message you want to verify, to 50365.

We will reply to confirm if we sent the Text Message to you or if it’s a scam.Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)Calling from ROI

Freephone: 1800 946 764 (personal and business)Calling from Overseas

Not Freephone: 00353 567 757 007Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

-

People’s Energy Data Breach

The purpose of this alert is to inform Bank of Ireland UK customers of the People’s Energy Data Breach.

Summary

Bank of Ireland UK have been advised that on 16 December 2020 People’s Energy discovered that it had a data breach. The hackers had stolen the data of approximately 270,000 current and previous customers. The data stolen included customer names, addresses, date of birth, telephone numbers, tariff and energy meter IDs. It has been reported that hackers did not obtain the financial details of these customers.

We understand that People’s Energy has notified all of its impacted customers and any enquiries should be made directly with them.

We would like to remind our customers to remain vigilant against fraud. Even though bank details were not stolen in this instance, customers of People’s Energy will be more vulnerable to Vishing or Phishing fraud, where the stolen details are used by the criminals to target victims and scam them into giving out their bank details.

Suspicious calls (Vishing)

Be vigilant if you receive a phone call out of the blue from someone claiming to be from your bank, credit card company or another company you trust. They may claim that your account has been compromised and ask you for your bank card or bank account details. Remember: Bank of Ireland UK will never ask you to transfer money out of your account.

What to look out for:

- Unexpected calls claiming to be from your bank, credit card company or well-known company that you trust.

- Being asked to confirm your password, full login PIN or bank account number.

- Urgent requests and threats.

- Claims that your account has been compromised or there is something wrong with a payment.

- Requests to transfer money out of your account, for example using a money transfer service.

- The fraudster might tell you the first four digits of your card number and ask you to confirm the rest.

- Being asked if you made a recent transaction at a well-known store, such as a supermarket. The fraudster is only guessing this information to sound more believable.

- Claims that some payments have already been made from your account to a foreign country and that they can ‘stop’ any more going through.

- Please note, the Bank, Police or any other genuine organisation will never ask for your help in investigating crime. If you are contacted with a similar request, please end the call immediately and call us, preferably from a different phone, to inform us of the suspicious call.

Suspicious emails (Phishing)

Fraudsters sometimes send emails pretending to be from your bank, credit card company or another company you trust, usually asking you to click on a link or open an attachment. The emails may seem genuine and convincing but are designed to trick you into sharing your personal information, such as your username, full PIN or credit card number. They will often make urgent threats and try to scare you into providing your details.

What to look out for

- Check for misspellings or unfamiliar sender addresses.

- Unexpected emails which claim to come from a financial institution.

- Urgent requests and threats.

- Claims that your account has been compromised.

- Requests to “Open an Attachment” or “Click a Link”.

Further information

To find out more about fraudster Tactics, and what you can do to protect yourself please refer to the Fraudster tactics section of our website.

Report Fraud

If you suspect suspicious activity on your account, or if you have provided personal information in response to a suspicious email, text or telephone call, please contact us as soon as possible on the below contact numbers:

Northern Ireland

Freephone (Personal accounts): 0800 121 7790 (24 hours, 7 days a week).

365 Online: 0345 7 365 555Great Britain

365 Online: 0345 7 365 333Republic of Ireland

365 Online: 1890 365 200/ 0818 365 365Abroad

365 Online: +44 345 7365 555365 Opening hours: Monday-Friday: 8am-8pm, Saturday: 9am-5pm, Bank and Public holidays: 10am-5pm, Sunday: Closed.

To report suspicious Bank of Ireland related emails or texts, send the suspicious email or text to 365security@boi.com

If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

-

Christmas Shopping Fraud aware

Christmas shopping creates the busiest time of year for retail, due to Covid-19 this year a lot of people will be doing their Christmas Shopping online. Fraudsters will try to take advantage of this so we are reminding our customers to take extra care when doing their Christmas shopping online this year.

What to look out for

Is the website safe?

- Always go directly to the site or access it via a search engine (e.g. Google, Bing) first. Never follow links on websites or in emails if you are suspicious.

- Ensure the web address is what you expected (e.g. check for incorrect spelling).

- When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- A closed padlock icon is present.

- Your browser address window may be green.

- Always ensure you are buying only from reputable retailers, whether from personal experience or trustworthy recommendations. If it is not a well-known shopping site, do some research and look for independent reviews rather than trusting testimonials on the site itself.

- Use a guaranteed payment method such as PayPal when shopping online.

- If it looks too good to be true, it probably is.

- Always view large purchases in person prior to paying for them.

Fraudster Tactics

Fraudsters will try to contact people by email, text, phone, social media and home visits with an aim of scamming you into giving them your money. Please refer to the Protect yourself section of our website to find out more about how you can identify suspicious activity, and what you can do to protect yourself.We encourage you to Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

If you get a suspicious call or email, especially after sending a tweet to us, or if you notice any suspicious activity:- Terminate the call without providing any personal details or financial information.

- Do not respond to or click on any links in suspicious texts or emails.

- Never provide your full banking PIN to anyone.

- Report your concerns to 365security@boi.com (include the phone number, a screenshot of the text if possible, or forward the email).

You can also contact us on one of the emergency numbers below (do not use a phone number given to you in the text or email as this could be fake):

Northern Ireland

Freephone (Personal accounts): 0800 121 7790 (24 hours, 7 days a week).

Freephone (Business accounts): 0800 032 1288 (24 hours, 7 days a week).

365 Online: 0345 7 365 555

Business Online: 0345 309 8123Great Britain

365 Online: 0345 7 365 333

Business Online: 0345 309 8124

Lost/Stolen cards: 0800 121 7790 (24 hours, 7 days a week)Republic of Ireland

365 Online: 1890 365 200/ 0818 365 365

Business Online: 1890 818 265

Lost/Stolen cards: +353 5 6775 7007 (24 hours, 7 days a week)Abroad

365 Online: +44 345 7365 555

Business Online: +353 1 440 6445

Lost/Stolen cards: +353 5 6775 7007 (24 hours, 7 days a week)365 Opening hours: Monday-Friday: 8am-8pm, Saturday: 9am-5pm, Bank and Public holidays: 10am-5pm, Sunday: Closed.

Business Online Opening hoursMonday-Friday 8am-6pm. Closed Saturday, Sunday, Bank and Public holidays.

If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

-

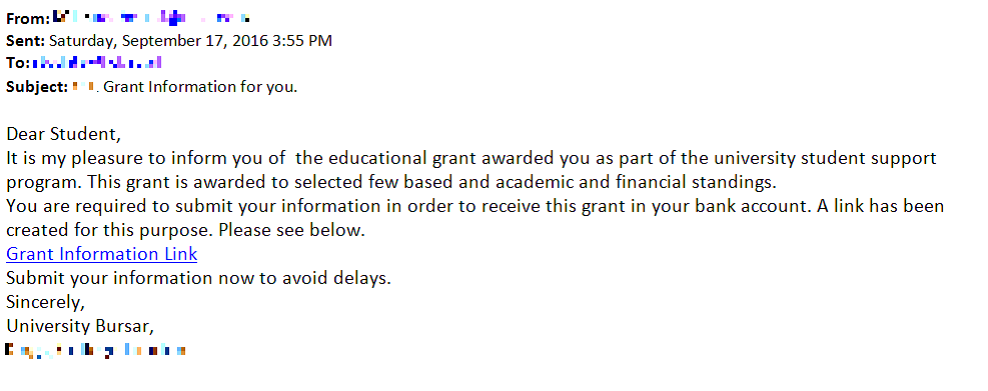

Phishing scam targeted at university students

The purpose of this alert is to raise awareness of a phishing scam targeted at students in UK universities.

The phishing campaign claims that the student has been awarded an educational grant as part of a student support programme. The email example below purports to have come from the Finance Department of the student’s university. It tricks the recipient into clicking on a hyperlink contained in the message to provide personal details on a webpage.

Victims report that after submitting their sensitive information (including name, address, date of birth, bank account details, National Insurance Number and mother’s maiden name), they were taken to a spoofed website which appeared to be a genuine representative of their online bank, where they were directed to type in their online banking credentials.

Protection and Advice

- Don’t open attachments or click on the links within any unsolicited emails you receive, and never respond to emails that ask for your personal or financial details.

- An email address can be spoofed, so even if the email appears to be from a person or company you know of, but the message is unexpected or unusual, then contact the sender directly via another method to confirm that they sent you the email.

- If you receive an email which asks you to login to an online account, go directly to the website yourself instead of using the link provided in the email.

- If you suspect an email is a scam, do not reply to the sender. Where possible, flag the email as spam and then delete it.

- Always install software updates as soon as they become available. Whether you’re updating the operating system or an app, the update will often contain fixes for critical security vulnerabilities.

- If you think your bank details have been compromised and/or you have lost money due to fraudulent misuse of your cards, you should immediately contact the bank and report it to Action Fraud.

-

Fraudsters using spoof bank texts in a new scamThe Press Office of Financial Fraud Action UK have put together a SMS Spoofing scam alert on behalf of the banking industry, this was released to the public on 9th June and the media coverage of the alert has been extensive and very successful. This fraud alert is to make customers aware of this new scam.

Key Points:- Criminals are using spoof text messages which appear to be sent from their victim’s bank in a bid to steal personal or financial information.

- The scam text messages claim that there has been fraud on the recipient’s account or that the account details need to be updated.

- The texts encourage people to call a number or visit a website, often claiming the matter is urgent. However the telephone number or website is actually controlled by the fraudster, enabling them to steal security details which can be used to access the victim’s bank account and steal money.

- To make the texts seem authentic, fraudsters use specialist software which alters the sender ID on a message so that it appears with the name of a bank as the sender. This can mean that the text becomes included within an existing text message thread on the recipient’s phone.

- Through a second route the fraudsters take, the texts warn that the recipient will soon receive a call from their bank’s fraud department. However it is actually the fraudster that then calls the victim and attempts to trick them into revealing their full security details.

- Intelligence also suggests that fraudsters are sending scam texts which appear to be from a landline number, asking the recipient simply to call their bank. This is in the hope that the victim will phone the number from which the text was sent, which is controlled by the fraudster, rather than the bank’s regular customer service telephone number.

Advice:

Financial Fraud Action UK’s advice on how to avoid becoming a victim of this scam:- Be suspicious of any text message that asks you to provide sensitive personal information, passwords or to make transactions.

- If you’re asked to call the number given in the text message and the number is unknown to you or suspicious, call your bank on a number that you trust – such as the one on the back of your card – to check the number and message is authentic.

- Do not call the phone number a text message has been sent from; instead call your bank on a number that you trust.

Remember your bank will never:- Phone you to ask for your 4-digit card PIN or your online banking password, even by tapping them into the telephone keypad.

- Ask you update your personal details by following a link in a text message.

- Tell you over the phone how to respond to a text message confirming a transaction.

- Ask you to transfer money to a new account for fraud reasons, even if they say it is in your name.

-

Malicious SoftwareThe National Crime Agency ‘NCA’ (UK) recently issued an alert in relation to Malicious Software (Malware). This arises from the identification and shut-down by international Law Enforcement authorities of over 1m compromised computers (a ‘botnet’). The Agency is advising the public that they have two weeks before hackers regroup and recommence their criminal activities against unsuspecting and unprotected computer users.

The authorities indicate that if your computer does not run Windows, then this alert may not apply directly to you. Other problems might though, and in order to keep yourself protected, you should always keep your antivirus up to date.

Advice (particularly for Windows users)

You can protect yourself by:

- Making sure security software is installed on your PC and is kept updated by running scans

- Check that your computer operating systems and applications are up to date

- Regularly back up all your files, especially Word, Excel and Powerpoint documents along with your Photos and any other items you would not like to lose. Store this information securely (encrypted) in a separate storage device

- Do not open attachments in emails unless you are 100% certain that they are authentic

For further information Get Safe Online is providing advice, guidance and tools on its website at www.getsafeonline.org/nca

-

Pension LiberationPension Liberation also known as ‘pension loans’ and ‘pension scam’ is a transfer of a scheme member’s pension savings to an arrangement that will allow them to access their funds before the age of 55. But accessing pension savings before minimum pension age is only possible in rare cases, like terminal illness.

Pension Liberation can result in tax charges and penalties of more than half the value of a member’s pension savings, and those being targeted are usually not being told about the potential tax implications. This is in addition to high charges, typically 20 to 30% for entering into one of these arrangements and high risk investments for the remaining pension savings.

Warning signs

- Unsolicited contact

- Transfer of funds overseas

- Attempts to access pension before the age of 55

- Copy of documentation has not been provided to member

- Member encouraged to carry out transfer quickly

- Receiving scheme not registered/newly registered with relevant Revenue authority

- Member informed there is a legal loophole

Action:

The pension Regulator’s five steps to avoid becoming a victim:- Never give out financial or personal information to a cold caller

- Check the credentials of the company and any advisers – who should be registered with the appropriate regulatory authority, e.g. the Financial Conduct Authority.

- Ask for a statement showing how your pension will be paid at retirement, and question who will look after your money until then

- Speak to an adviser that is not associated with the deal you’ve been offered, for unbiased advice

- Never be rushed into agreeing to a pension transfer

For further information on Pension Liberation see:

-

Scam callsKey Points:

- It has come to our attention that there has been a marked increase in fraudulent calls to mobile phones in recent weeks.

- The phone number on the incoming call appears to begin with “+4212/60”. The distinguishing characteristic of the caller’s number is the inclusion of the forward slash.

- While recipient experience in taking the calls varies, answering a call from this number always results in a premium rate charge appearing on the customer’s bill.

Action:

Law enforcement intelligence advises everyone to be cognisant of the issues surrounding unsolicited calls from unknown numbers and to be vigilant in this regard.

-

Fraud against the elderlyElderly people can be particularly at risk from bogus traders/callers who set out to gain their confidence before taking financial advantage of them.

Typically these people call door-to-door and offer to carry out works such as replacing roof tiles, mending guttering, decorating or they ‘convince’ the victim that repairs are necessary. Some of these people carry out a little work and charge exorbitant amounts of money for their service. In many cases the work is unnecessary. On completing the work in a very short time, they then demand substantial payment often using threatening and intimidating tactics. In some instances, they offer to drive the victim to the bank to withdraw the cash.

Always remember:

You should never leave strangers, even bona fide workers, unsupervised in your home.Never engage a person who insists on cash payments for services offered. Most reputable traders will not ask for money up front. Always use a method of payment which is traceable.

Never sign a blank form for any reason – it could cost you dearly.

-

Money Mules - (Job vacancies)Money mules are people recruited by criminals to help transfer fraudulently obtained money from bank accounts. Fraudsters contact prospective victims with ‘job vacancy’ adverts on the internet, on job search websites or in newspapers. These jobs are usually advertised as ‘Financial Manager’ or ‘Payments Clerk’ with no other requirement than having a bank account. The mule accepts the ‘job’ in good faith and does not suspect that they are being duped into involvement in criminal activity. Once recruited a Money mule receives stolen funds into their account, followed by a request to forward the funds, minus their commission, usually overseas, using a wire transfer service.

Always remember:

Thoroughly research any work-from-home offer and do not get involved unless you are sure the business is legitimate.

If a job sounds too good to be true, then it probably is.

-

Lottery FraudAnother scam currently being carried out by various groups of international fraudsters involves victims being contacted by email in which they are advised that they have won the lottery. No ticket purchase was necessary – according to the scammers. The victim is encouraged to pay a fee before the ‘winning’ lottery cheque is handed over. This scheme is a fraud and you should not become involved or communicate with them in any way as these winnings do not exist.

-

Boiler room investor fraud

The Bank wishes to alert Customers and members of the public to the threat of share sale fraud – more commonly known as Boiler Room scams.

Share sale, boiler room, hedge fund or bond fraud involves bogus brokers, usually based overseas, cold calling people to pressure them into buying shares that promise high returns or whose share price is about to ‘go through the roof’. In reality, the shares are either worthless or non-existent.

Boiler room fraudsters are highly trained and use ‘hard sell’ techniques to pressurize investors into making rushed decisions to buy shares which are of little or no value.

If you deal with a share sale fraudster or Boiler Room you’ll almost certainly lose the money you’ve invested and you won’t have any right to claim compensation under the Financial Services Compensation Scheme, as the Boiler Room firm is NOT AUTHORISED as an investment firm by the Financial Conduct Authority.

Key points:

Most Boiler Room scams start with an UNSOLICITED phone call, in which a professional sounding ‘stockbroker’ offers you a fantastic investment opportunity.

These salespeople are persistent and are trained in dealing with any objections or questions, they specialize in using high pressure ‘hard sell’ tactics in order to persuade victims to agree to buy shares, they will often claim that by agreeing to buy the shares you have ‘entered into a contract’ to do so.

They will urge you to be discreet and not to tell anyone else about the deal, this enables them to continue cold calling hundreds of other potential victims while the scam is running.

In order to appear legitimate, firms will often have websites which look professional, they may provide official-looking documentation and share certificates, all these are ultimately worthless.

As most Boiler Rooms are based overseas you will be asked to send your “investment” by International Payment, you will probably never get any money back.

Remember: if it looks too good to be true, it probably is!

Advice for Customers:

If you receive an UNSOLICITED call from a person who offers you an opportunity to invest in shares HANG UP.

Genuine UK investment firms are authorised by the Financial Conduct Authority. If you wish to check whether a firm is authorised you may do so on their website:

www.fca.org.uk/firms/systems-reporting/register

If in doubt, refer your query to a Qualified Financial Advisor who is known to you – explaining why you are concerned.

If you think you may have been duped by a boiler room scam you should report it to the Financial Conduct Authority and to the Police.

Recovery Fraud:

People who have lost money on Boiler Room scams may subsequently find themselves being targeted in a ‘recovery room’ fraud, where the victim receives a call from a firm who will claim that they can help to recover the lost investment monies.

This however, is simply another part of the boiler room scam and the ‘recovery’ firm will request upfront payment of substantial fees before they handle your case, again this is just another way of scamming more money from victims.