Current Accounts

- Enjoy everyday free banking with all our accounts

- Free Text Alerts to help you manage your money

- Free withdrawals in Euros from our cash machines in Ireland

- Debit card payments using Google Pay and Apple Pay

- Take out and lodge money at the Post Office

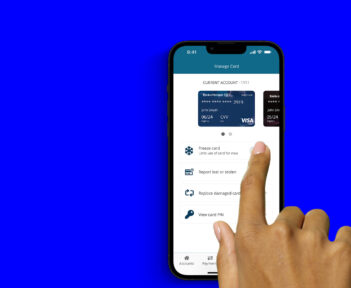

- Manage money in-branch, phone, online or using the Bank of Ireland banking app

- Switch using the Current Account Switch Service in just 7 working days

Products no longer on sale

NI Current Accounts

These accounts are no longer available to new customers. Please click here to view the overdraft rates currently charged. To apply for an overdraft please go to the Overdrafts page.