Useful Links

Useful Documents NI

Additional information can be found on the following pages:

Useful Documents GB

Supporting Your Business

Business Products

Switch to Bank of Ireland UK

If your Bank doesn’t give you the service you need, why not switch to one that will.

Lending Standards Board

Bank of Ireland UK adheres to the Standards of Lending Practice which are monitored and enforced by the Lending Standards Board. A copy of the Statement of Lender and Borrower Responsibilities for Business Customers leaflet is available here:

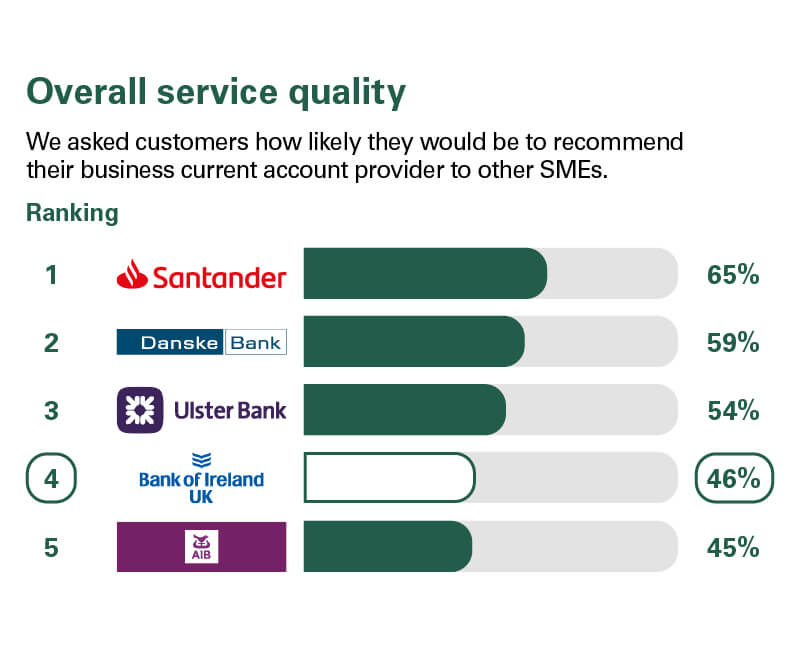

Independent Service Quality Survey Results

As part of a regulatory requirement, an independent survey was conducted to ask customers of the five largest business current account providers if they would recommend their provider to other small and medium enterprises (SMEs). The results represent the view of customers who took part in the survey. See full results here.