09 November 2015

- 30% more likely to invest in BTL as a result of stock market turmoil

- BTL Index: Positive Index score of 61.4 with half of UK homeowners interested in becoming a landlord

- BTL viewed as better performing than any other form of investment

- 3/4 of landlords say new changes to tax relief will make no difference to their investment attitude

Recent stock market volatility appears only to be fuelling confidence in the UK’s buy-to-let market, according to nationwide research undertaken by Bank of Ireland UK.

The latest findings in the quarterly research show that almost 30% of British landlords are more likely to invest in buy-to-let properties as a result of concerns about growth in China and the Eurozone. 2/3rd of those surveyed said that the recent turmoil would make no difference to their investment attitude with only 8% less likely to invest in BTL.

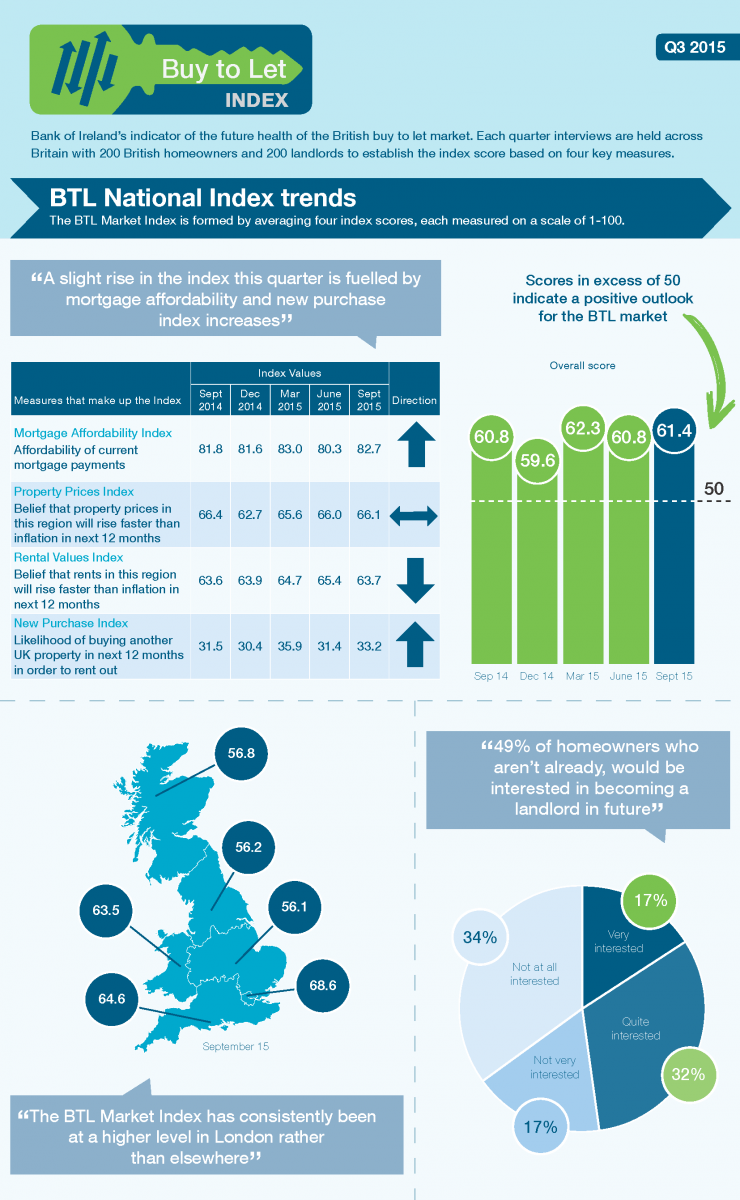

Bank of Ireland UK, is a leading provider of specialist buy-to-let mortgages. The results of the sixth edition of the Index revealed a positive view of the market at 61.4, remaining above 60 for the third quarter in a row and up from 58.7 in the first wave of research in June 2014. Scores in excess of 50 out of 100 indicate a positive outlook for the UK’s buy-to-let market.

The research is part of the Bank of Ireland UK buy-to-let index which is undertaken each quarter amongst British property owners to monitor the attitudes of private landlords and homeowners in the buy-to-let market and give an indicator of the future health of the British buy-to-let market.

This positive sentiment towards BTL investments is also felt by British homeowners with almost half of respondents saying that they would be interested in becoming a BTL landlord in the next two years if they could afford it.

For the sixth survey in a row Londoners have been shown to be the most property-hungry, with over 66% saying that they would be interested in becoming a BTL landlord. The lowest levels of interest were seen in Scotland and the North.

Greater London’s index score of 68.7 for the year end September means it maintains its position as the highest in the country, despite dropping from its 69.3 level in March this year. The findings also revealed the lowest levels of confidence in the BTL market to be in Wales and the North, with the relevant index scores coming in at 54.4 and 54.8 respectively.

This, the sixth wave of the survey shows that BTL is now so attractive that property owners believe it to be better than any other type of investment over the long term.

Almost 70% of British homeowners believe that BTL will outperform other forms of investment over the long term – with 68% believing BTL will outperform cash investments, 66% for shares/equities and 56% government bonds.

Despite the Chancellor’s announcement that he is to cut tax relief for BTL landlords, they remain upbeat about the market, with 73% of landlords saying these restrictions will not affect their attitude towards BTL. Though this attitude could change once the amendments come into effect in April 2017 and landlords feel the pinch.

Mark Howell, Director of Marketing & Customer Management, Bank of Ireland UK Mortgages said: “This sixth wave of our quarterly survey has shown that confidence in the BTL market remains robust, despite news stories in the press which might have suggested otherwise.

“It is a sign of the current economic climate that many are seeing BTL as a prime investment – and that they believe it will outperform all other forms of investments”

– ENDS –

Note to Editors:

- Survey of 400 British property owners in September 2015

- 200 private landlords (small landlords only, those with under 10 properties in their portfolio)

- 200 homeowners (who either own their own home outright or are buying it on a mortgage)

- The BTL Market Index is formed by aggregating and averaging four index scores, each of which is measured on a scale of 0 to 100:

- MAI Mortgage Affordability Index (how affordable overall are your current mortgage payments, for all your UK properties taken together- from 0 = not at all easily affordable to 100 = very easily affordable).

- PPI Property Prices Index (belief that property prices in this region will rise faster than inflation in next 12 months- from 0 = not at all likely to 100 = very likely)

- RVI Rental Values Index (belief that rents for private property in this region will rise faster than inflation in next 12 months- from 0 = not at all likely to 100 = very likely)

- NPI New Purchase Index (likelihood of buying another UK property on a mortgage or outright over next 12 months, to rent it out – from 0 = not at all likely to 100 = very likely)